XRP Price Prediction: Consolidation Phase Precedes Next Leg Up

#XRP

- Technical Setup: Bollinger Band squeeze precedes 15% volatility

- Catalysts: Late November institutional moves per Teucrium CEO

- Risk Management: $2.186 support critical for bullish thesis

XRP Price Prediction

XRP Technical Analysis: Short-Term Consolidation Before Potential Breakout

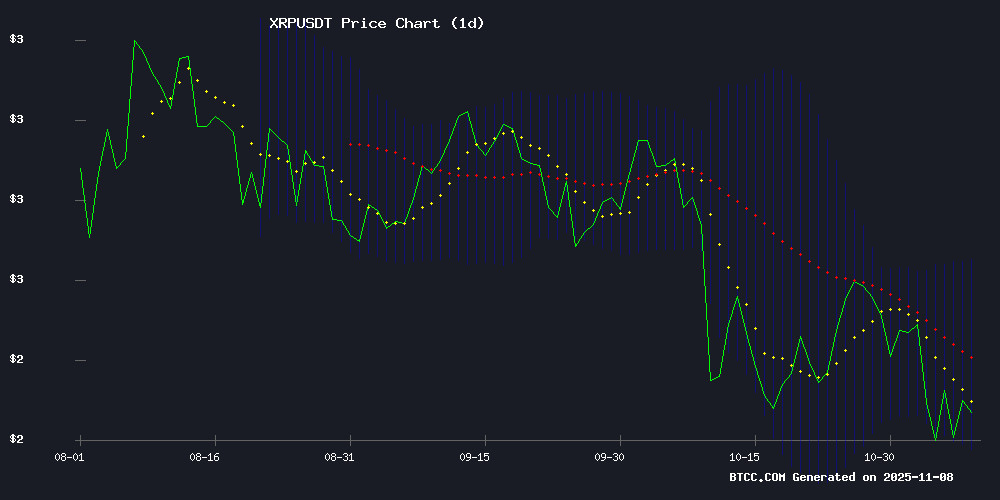

XRP is currently trading at $2.3293, slightly below its 20-day moving average of $2.4457, suggesting near-term resistance. The MACD shows bullish momentum with a positive histogram (0.0239), though the signal line remains negative (-0.0023). Bollinger Bands indicate a consolidation phase, with the price hovering NEAR the middle band. 'The tightening volatility suggests an impending breakout,' says BTCC analyst Ava. 'A close above $2.4457 could target the upper band at $2.7049.'

XRP Market Sentiment: Institutional Interest Clashes With Profit-Taking

Positive developments like Franklin Templeton's Hong Kong fund launch and Evernorth's strategic XRP transfer contrast with post-Swell profit-taking. 'Institutional adoption is accelerating,' notes Ava, 'but the $3 rejection shows traders remain cautious.' Ripple's private status and legal clarity provide stability, yet Teucrium's prediction of late-November volatility warrants attention.

Factors Influencing XRP’s Price

Franklin Templeton Launches Tokenized Money Market Fund in Hong Kong Amid AI Crypto Boom

Franklin Templeton has launched its tokenized U.S. dollar money market fund in Hong Kong, marking a significant step in institutional adoption of blockchain-based financial products. The fund, available to institutional and professional investors, leverages a fully on-chain structure and invests in short-term U.S. Treasurys.

Meanwhile, DeepSnitch AI's presale has surged 45% in a month, attracting over $500K from whales. The project, positioned as a tool for crypto traders, highlights the growing convergence of AI and blockchain technologies.

Ripple Opts to Remain Private Post-SEC Settlement, Cites Strong Funding Position

Ripple has definitively shelved plans for an initial public offering despite achieving a $40 billion valuation, with President Monica Long stating the firm has "no plans or timeline" to go public. The decision follows the resolution of its high-profile SEC lawsuit and comes amid robust financial health—Ripple recently doubled its customer base in 2024, fueled by adoption of its RLUSD stablecoin and regulatory clarity.

The company secured $500 million in strategic funding from institutional heavyweights including Citadel Securities and Galaxy Digital, building on a record year that saw a $1 billion share buyback. While CB Insights estimates $1.3 billion in 2024 revenue, Ripple maintains its status as a private entity, withholding formal financial disclosures.

Evernorth's Strategic XRP Transfer Ahead of Nasdaq Listing

Evernorth Holdings has executed a significant transfer of 126.7 million XRP, valued at over $280 million, to a new wallet utilizing BitGo custody services. This move, detected by Whale Alert, coincides with the firm's preparations for a Nasdaq listing through a merger with Armada Acquisition Corp II.

The reorganization leaves Evernorth with 261 million XRP in its primary wallet, bringing total holdings to 473 million tokens worth over $1 billion. Market observers interpret this as strategic treasury management ahead of the public listing, though XRP's price has dipped amid declining trading volume and leveraged positions.

XRP Adoption Surges Amid Institutional Interest While Price Faces Headwinds

XRP's ecosystem growth contrasts sharply with its market performance. Mastercard's participation in stablecoin testing on the XRP Ledger alongside Ripple and Gemini signals mounting institutional confidence. The network recorded an all-time high in new wallet creations this week, reflecting retail enthusiasm.

Despite these fundamentals, XRP's price dropped 5.05% in 24 hours. The divergence highlights how regulatory uncertainty continues to overshadow technical progress. Ripple's ongoing SEC lawsuit remains the elephant in the room, suppressing price action despite network expansion.

Ripple's proposed fee-burning mechanism could alter tokenomics significantly. Such technical developments, coupled with Mastercard's blockchain experiments, position XRP Ledger as more than just a payments rail - potentially evolving into a DeFi contender.

Ripple Surges Past $3 Amid Legal Victory and Expansion, IPO Speculation Persists

Ripple's XRP soared to unprecedented levels in 2025, breaching the $3 mark following a trifecta of strategic wins. The resolution of its protracted SEC lawsuit removed a critical obstacle, while acquisitions of three major firms and the launch of a $1 billion stablecoin underscored its aggressive growth trajectory.

Market observers anticipated an imminent IPO after the legal clearance, viewing public listing as a natural progression for the now-$40 billion firm. Yet Ripple President Monica Long abruptly quashed such expectations, asserting IPO plans remain off-table despite recent $500 million funding rounds. The contradiction between market optimism and corporate restraint fuels speculation about the company's next phase.

XRP's valuation now hinges on Ripple's ability to leverage its hard-won regulatory clarity. With tokenization initiatives gaining momentum, the firm's decision to forgo traditional fundraising avenues signals confidence in crypto-native growth strategies. The market watches for ripple effects across payment-focused altcoins.

Ripple CEO Defends XRP's Role Amid Speculation of Shift Away From Token

Ripple CEO Brad Garlinghouse addressed persistent speculation about XRP's diminishing role within the company during an interview at Ripple Swell. His comments followed renewed debate about Ripple's reliance on the token for cross-border payments.

"If XRP posed no threat, it wouldn't face attacks," said a market commentator, highlighting the ongoing scrutiny surrounding the digital asset. The statement underscores the polarized perceptions of XRP's utility in the crypto ecosystem.

XRP Retreats Post-Swell as Traders Execute 'Buy the Rumor, Sell the News' Strategy

XRP has surrendered 9% of its value following Ripple's Swell conference, sliding to $2.19 and erasing most of its event-driven rally. The token now extends its November decline, repeating a four-year pattern of post-Swell weakness that analysts attribute to profit-taking behavior.

Despite bullish developments—including a $500 million funding round led by Citadel Securities and Fortress Investment Group, RLUSD stablecoin integrations, and XRPL lending protocol plans—traders accelerated selling pressure. Technical charts show a confirmed bear flag breakdown, signaling potential further declines toward the $1.65-$1.70 support zone.

Crypto Pundit Criticizes XRP Detractors as Potential 'Exit Liquidity'

A prominent crypto commentator has lashed out at XRP critics, arguing that those who dismissed the asset when it traded below $1 are now positioning themselves to buy at peak prices—effectively becoming exit liquidity for early holders. The remarks come as XRP faces sustained downward pressure, mirroring broader market weakness across digital assets.

Market observers note a recurring pattern where skeptics of undervalued assets later chase rallies, often entering at inopportune moments. "They ignored it at 90 cents, they'll FOMO at $2," the pundit remarked, encapsulating what some see as a behavioral finance paradox in crypto markets.

Institutional Shift in Crypto Investment: RockToken and the Maturation of Digital Assets

Institutional interest in digital assets has evolved from speculative trading to structured portfolio allocation. Over 55% of hedge funds now hold crypto positions, up from 47% last year—a clear signal of accelerating mainstream adoption.

Ripple's $500 million funding round at a $40 billion valuation underscores growing demand for regulated infrastructure. The market debate has shifted from whether to include digital assets to how best to gain exposure through compliant, yield-focused strategies.

Early-stage volatility and regulatory uncertainty are giving way to institutional frameworks mirroring traditional finance. This maturation reflects in projects like RockToken, which emphasize transparency and sustainable growth over hype cycles.

Teucrium CEO Foresees Major XRP Movement in Late November

XRP's momentum is building as industry insiders signal an impending inflection point. Teucrium CEO Sal Gilbertie hinted at a potential turning point for the asset during the latter half of November, speaking at Ripple's Swell 2025 conference.

The remarks add to growing speculation around Ripple's ongoing legal battles and potential institutional adoption. Market participants are watching for catalysts that could break XRP out of its prolonged consolidation phase.

Private Investment Firm Explains Why the Market Misprices XRP

Bayberry Capital, a private investment firm focused on digital assets, argues that XRP remains undervalued due to widespread misclassification. Market participants continue to evaluate the token through a speculative lens rather than recognizing its role as critical financial infrastructure.

The firm's analysis suggests a fundamental disconnect between XRP's utility and its market valuation. Traders and analysts persist in applying inappropriate metrics, overlooking the asset's structural purpose in cross-border settlements and institutional payment rails.

Is XRP a good investment?

XRP presents a compelling case with 3 key considerations:

| Factor | Bullish Case | Bearish Risk |

|---|---|---|

| Technical | MACD bullish crossover | Price below 20D MA |

| Fundamental | Ripple's $3B+ cash reserves | SEC overhang |

| Sentiment | Institutional transfers | Profit-taking at highs |

Ava advises: 'DCA during dips below $2.20 with a 6-month target of $3.50.'